What Happens to Housing when There’s a Recession?

October 25, 2022

October 25, 2022

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short.”To add to that sentiment, housing is typically one of the first sectors to rebound during a slowdown. As Ali Wolf, Chief Economist at Zonda, explains:

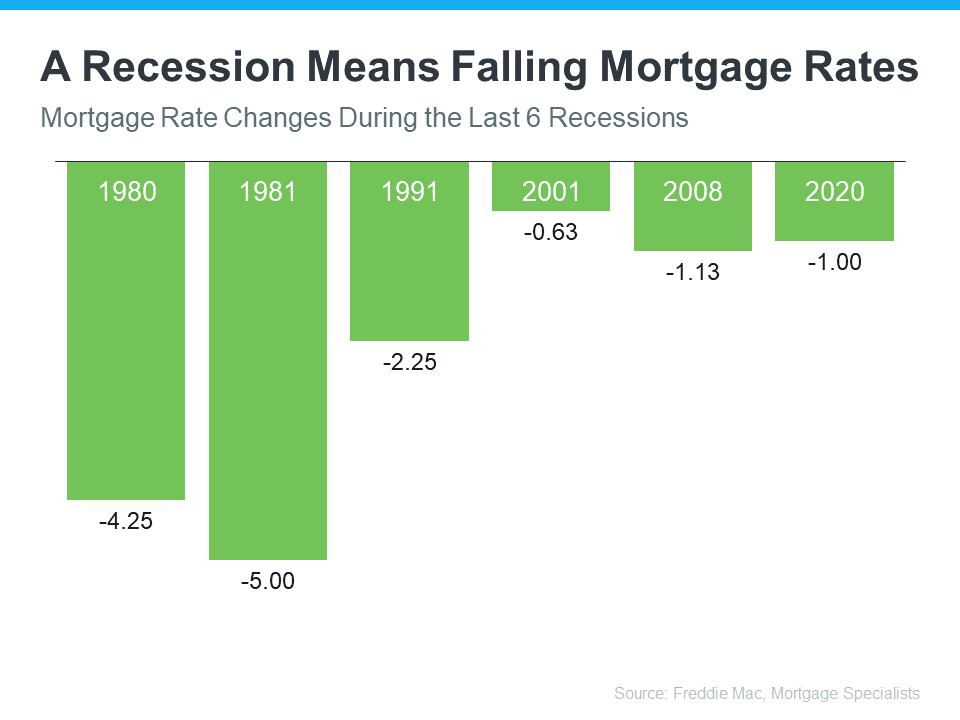

“Housing is traditionally one of the first sectors to slow as the economy shifts but is also one of the first to rebound.”Part of that rebound is tied to what has historically happened to mortgage rates during recessions. Here’s a look back at rates during previous economic slowdowns to help put your mind at ease.

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”While history doesn’t always repeat itself, we can learn from and find comfort in the trends of what’s happened in the past. If you’re thinking about buying or selling a home, you can make the best decision by working with a trusted real estate professional. That way you have expert advice on what a recession could mean for the housing market.

Stay up to date on the latest trends in real estate.

December 19, 2025

How efficiency, sustainability, and lower utility costs are redefining home value

December 12, 2025

A Year-End Look at Prices, Inventory, and What’s Ahead for 2026

November 5, 2025

A breakdown of the latest Texas property tax updates and what they mean for El Paso homeowners in 2025.

September 15, 2025

10 Ways to Revamp Your Kitchen Before Selling

September 8, 2025

How Buyers and Sellers Can Leverage Assumable Mortgages to Beat High Interest Rates

September 2, 2025

Why a trusted agent is your best defense in today’s competitive housing market.

You’ve got questions and we can’t wait to answer them.